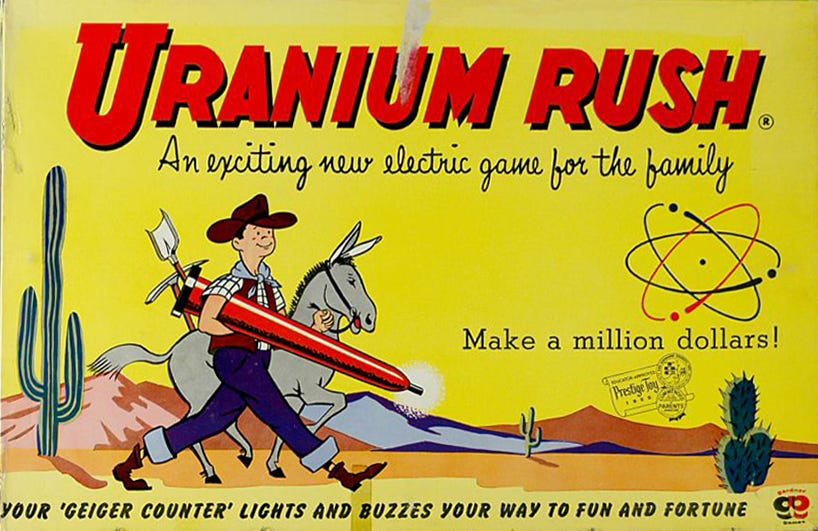

Uranium hype heats up + "No groundwater? No problem!"

Nearly 14,000 new homes have been built in Phoenix this year

⛏️Mining Monitor ⛏️

The mining world is a busy place these days, at least when it comes to hyping potential projects and enticing investors. Actual mining? Not so much — at least not yet.

The frenzy of activity is being spurred by a steep increase in uranium spot prices, from around $25 per-pound a …